Fernovo Loans Review: Fernovo is a UK-based direct lender offering short-term payday loans. Known for quick approvals and online applications, Fernovo caters to borrowers who may struggle to get credit from traditional banks. In this review, we’ll look at Fernovo’s loan features, interest rates, eligibility requirements, and whether it’s the right choice for you in 2025.What are Fernovo Loans? Let’s see its review?

Fernovo is a UK-based direct lender that offers short-term and payday loans. This is especially useful for people who have trouble getting credit from a traditional bank or large lender. Fernovo’s application process is completely online, which reduces paperwork and leads to faster approval.Fernovo loans in 2025 are becoming popular among borrowers who need money immediately — for unexpected bills, car repairs or emergency expenses. These loans are characterized by fast approvals, transparent fee structures and flexible repayment terms. However, interest rates can be higher than traditional personal loans, so it’s important to compare all the options before making the right decision.

In this review, you will learn:

Key features of Fernovo Loans

interest rates and charges

Who can apply

Repayment options and potential advantages/disadvantages

If you are thinking of taking a Fernovo loan in 2025, this guide will help you make the right and safe decision.

What is Fernovo Loans review Let’s see its?

Fernovo is authorised and regulated by the Financial Conduct Authority (FCA) in the UK.

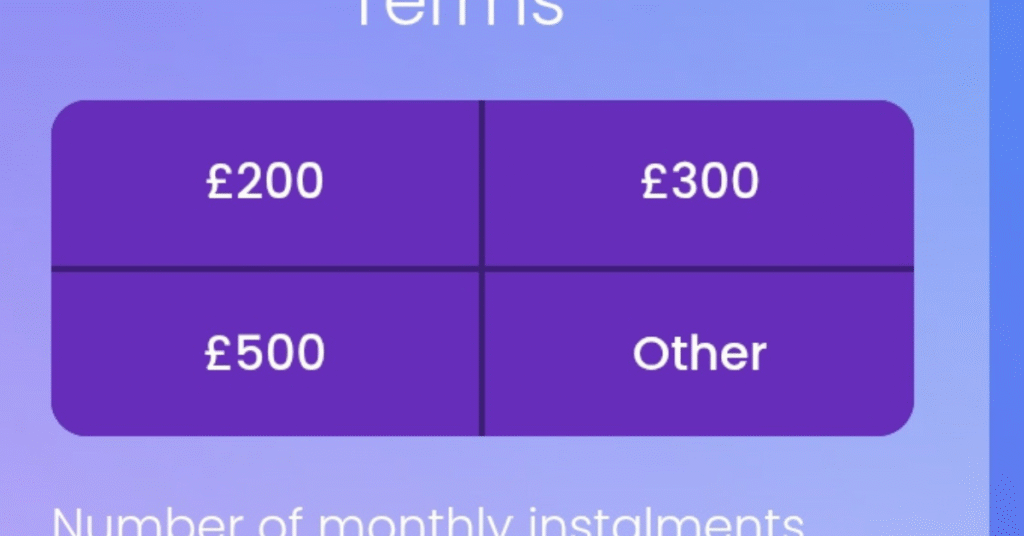

They provide payday loans for amounts typically ranging from £100 to £1,000, with repayment periods from 1 to 6 months.

Key Features of Fernovo Loans

Loan Amount: £100 – £1,000

Repayment Term: 1 – 6 months

Application: 100% online

Approval Time: Same day (in most cases)

FCA Registration: Yes (safe & regulated)

Table of Contents

Interest Rates & Costs

Fernovo Loans Come With a Representative APR of Around

1272%, which is common for payday loans but much higher than traditional personal loans.

Example: Borrow £500 for 3 months → Total repayment ~£750 (exact cost depends on creditworthiness).

Eligibility Requirements

To apply for a Fernovo loan in 2025, you must:

Be a UK resident

Be at least 18 years old

Have a regular income

Hold a valid UK bank account and debit card

Pass affordability and credit checks

How to Apply for a Fernovo Loans

1. Visit the official Fernovo website

2. Choose your loan amount & term

3. Fill in the online application form

4. Submit ID & income verification if required

5. Get approval decision (usually same day)

Pros and Cons of Fernovo Loans

Pros:

Fast approval & funding

FCA regulated (safe lender)

Accepts applicants with bad credit

Cons:

Very high interest rates

Not suitable for long-term borrowing

Late payment fees apply

Alternatives to Fernovo

QuickQuid (short-term loans)

Lending Stream

Peachy Loans

Credit unions (lower interest)

Final Verdict

Fernovo can be a quick solution for emergency cash needs if you have limited credit options. However, due to the high cost of borrowing, it’s recommended only for short-term emergencies and when you’re sure you can repay on time.

FAQs

Q1. What kind of financial help can I expect from Fernovo Loans

Fernovo primarily steps in when you need a quick financial boost for those unexpected moments. They specialize in short-term loans and payday loans, which are perfect for covering emergency expenses like an urgent car repair, a sudden medical bill, or any other immediate cash crunch that can’t wait until your next paycheck. They’re designed to be a temporary solution, not a long-term borrowing option.

Q2. Is it possible to get a Fernovo loan without needing a guarantor?

Absolutely, yes! One of the key advantages of Fernovo Loans is that they understand not everyone has someone readily available to act as a guarantor. Their loans are structured to be available without the need for a guarantor, which simplifies the application process and makes them accessible to a broader range of individuals who might otherwise struggle to secure credit.

Q3. How do Fernovo’s interest rates compare, and what should I keep in mind

It’s important to be aware that Fernovo’s interest rates, like most short-term and payday lenders, can be higher than those offered by traditional personal loans from banks. This is often because they cater to a different risk profile and offer quick, unsecured access to funds. Therefore, before you apply, always make it a priority to thoroughly read and understand the terms, conditions, and the Annual Percentage Rate (APR) to ensure you’re comfortable with the total cost of borrowing. Transparency is key here.

Q4. What paperwork will I generally need to provide to apply for a Fernovo loan?

Fernovo aims for a straightforward online application, but you’ll still need to provide some standard documentation to verify your identity and financial situation. Typically, this includes a valid form of identity proof (like a passport or driving license), recent proof of income (such as payslips or bank statements), and your UK bank account details where the funds will be transferred and repayments will be made. The exact requirements will be clearly outlined during the application process.

Q5. How fast can I expect to receive the loan funds after approval from Fernovo?

Fernovo is well-regarded for its speed, especially for those urgent financial needs. In most successful application cases, once your loan is approved, the funds can often be transferred to your designated bank account within a matter of minutes or just a few hours. This rapid disbursement is a significant benefit for borrowers facing immediate expenses, though the exact timing can sometimes depend on your own bank’s processing times.