Term Life- Insurance is one of the Most affordable ways to protect your family financially if you pass away within a set period.

In the UK, it’s a papular choice for home owners, parents, and anyone with Financial dependent. In this 2025 guide, we’ll explain what term Life Insurance is How it works, it’s Costs, benefits and expert tips to get the best deal.

Term Life Insurance is a reliable cornerstone for those who want to protect their loved ones from an uncertain future. Whether you have an ongoing mortgage that you want to repay, or you want to leave a safety net for your children’s education expenses, this policy gives you peace of mind for a set time frame. It assures that in your absence, your family will receive a lump sum that can secure their financial goals. It is not just about a death benefit, but a wise investment in your family’s future.In this comprehensive 2025 guide, we will take a deep dive into what Term Life Insurance is and how it works. We will also discuss the factors that affect its cost, its key benefits, and expert advice that will help you get the best deal. Our goal is to give you all the information you need to make an informed decision.”

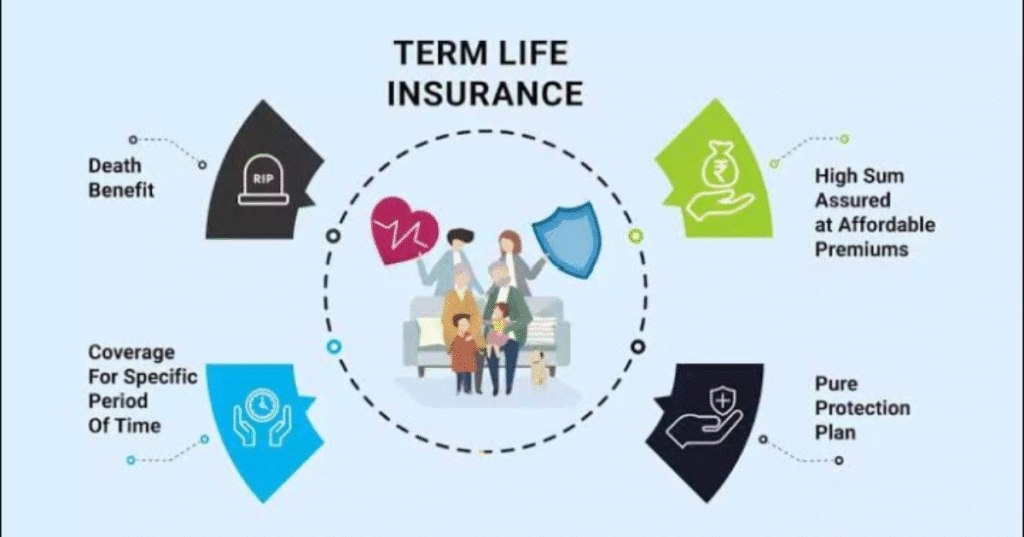

What is Term-Life Insurance

Term life insurance provides coverage for a fixed period, such as 10, 20, or 30 years. If you die during the policy term, your beneficiaries receive a lump sum payout. If you outlive the term, the policy ends, and no payout is made.

Term life insurance is ideal for covering temporary financial obligations such as a mortgage, child’s education, or other debts.

How does Term Insurance Work in the UK

- Step 1: Choose your Policy Term(e.g., 20 years).

- Step 2: Decide on the cover amount (sum assured).

- Step 3: Pay monthly or annual premiums.

- Step 4: If you die during the term, your family gets the payout.

💡 Pro Tip: Choose a term that matches your longest financial responsibility – for example, match your policy length with your mortgage term.

Table of Contents

Types of Term- Life- Insurance in the UK

Level Term Life Insurance

The payout amount stays the same throughout the policy. Best for fixed expenses like personal loans or income replacement.

Decreasing Term Life Insurance

The payout decreases over time, usually matching a repayment mortgage. Premiums are lower than level term.

Increasing Term Life Insurance

The payout increases over time to keep up with inflation. Premiums are higher but protect against rising living costs

Benefits of Term-Life Insurance

1. Affordable Premium: Lowest cost compared to other life insurance types.

2. Customisable Terms: Choose cover duration and payout amount.

3. High Cover Amounts: Suitable for large financial protection needs.

4. Flexible use: Can cover mortgages, debts, or provide for family living expenses

Pair your term life policy with critical illness cover to protect against serious health conditions that may stop you from working.

Cost of Term Life-Insurance in the UK 2025

Premiums depend on your age, health, lifestyle, and cover amount.

| Age | Cover-Amount | No-Smoker |

| 30 | £200,000 (20 year) | from £6/month |

| 40£ | £200,000 (20 year) | from £10/month |

💡 Pro Tip: Apply early – locking in premiums when young can save thousands over the policy term.

Term Life Insurance vs Whole Life

| Feature | Term Life | Whole Life |

| Coverage Duration | Fixed Term(10-40 year) | Life Time |

| Premiums | Lower | Higher |

| Payout | Only if death occurs during Term | Guaranteed |

| Cash Value | No | Sometimes yes |

How to Choose the Best Term Insurance in the UK

1. Match your Term to your needs

For mortgage cover, match your term to mortgage length.

2. Compare Multiple Quotes

Use comparison sites like CompareTheMarket or MoneySuperMarket.

3. Check Policy Features:

Look for terminal illness cover included at no extra cost.

4. Review Premium Type:

Choose guaranteed premiums to avoid price increases.

FAQs– Term Insurance UK

Q1. Is Term Insurance worth it in the UK?

Yes, it’s one of the most cost-effective ways to ensure your family’s financial security if you die within a set period.

Q2. What happens if I outlive my term life insurance?

Your policy ends, and no payout is made. You can take a new policy if needed.

Q3. Can I cancel my term Life insurance?

Yes, you can cancel anytime, but you won’t get any money back unless you have a return-of-premium policy

Q4. Should I choose level or decreasing term life insurance?

Level term is better for fixed expenses; decreasing term is more cost-effective for repayment mortgages.

Yes, it’s usually free from income tax. Place it in trust to avoid inheritance tax.

Q5. Is term life insurance payout tax-free?

Yes, it’s usually free from income tax. Place it in trust to avoid inheritance tax.

Pingback: Best One Week Car Insurance in the UK 2025 The Flexible