Retirement is one of the biggest milestones in life, and financial security plays a key role in making it stress-free. In the UK, the State Pension provides a regular income once you reach retirement age. However, many people are unsure about how much they will receive, when they can claim it, and what extra support may be available.

This guide explains everything you need to know about the State Pension in the UK, including when you can retire, how much pension you may get, how to increase it, and what other financial help you could claim.

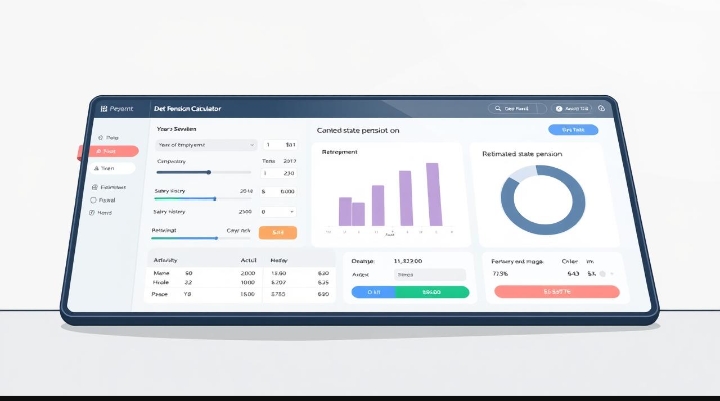

When are you retiring?

There is no longer a default retirement age in the UK. This means you are not forced to retire at 65, as was once the case. Instead, you can continue working beyond your State Pension age if you wish.

Your State Pension age depends on your date of birth and can be checked online using the government’s pension age calculator.

You can keep working after reaching your State Pension age.

👉 Knowing your pension age is the first step towards proper retirement planning.

Topics

Basic and New State Pension Rates?

| Pension Type | Weekly Rate | Annual Rate |

| New State Pension | £185.15 | £9,627.80 |

| Basic State Pension | £141.85 | £7,376.20 |

How Much State Pensions Will You Get

- The amount you receive depends on your National Insurance (NI) contributions throughout your working life.

- If you have a full National Insurance record, you may receive the full State Pension.If there are gaps in your record, your pension may be lower.

- If there are gaps in your record, your pension may be lower.

- You can use the State Pension forecast tool on the UK government website to find out exactly how much you are on track to receive. This gives you a clear idea of your future income and helps you plan ahead.

How can you increase your pension

If you are concerned that your pension may not be enough, there are steps you can take to increase it:

- Delay your Pension

If you choose to delay claiming your State Pension, the amount you eventually receive will be higher. Every week you defer adds extra to your future payments.

- Voluntary National Insurance Contributions

If your NI record has gaps (for example, if you were unemployed or not claiming benefits), you may be able to pay voluntary contributions. This can boost your record and increase your pension entitlement.

- Workplace or Private Pension

Alongside the State Pension, many people also save into a workplace or personal pension. These can supplement your income and provide greater financial security in retirement.

Other Financial Support Available

Retirement isn’t just about your State Pension. You may also be eligible for other financial help depending on your situation.

Low income support – Extra financial help if your income is below a certain level

Housing support – Help with paying rent.

Heating bills – Assistance with heating costs during cold weather.

Disability benefits – Additional support if you are disabled.

Free bus pass – Many pensioners can claim free bus travel, making transport more affordable.—

Why Planning Matters

Your retirement income is not just about numbers – it’s about ensuring you live comfortably without financial stress. Planning ahead helps you:

Understand how much money you’ll receive.

Identify whether you need extra sources of income.

Decide if you should delay your pension or make voluntary contributions.

Take advantage of all available financial support.

For professional guidance, you can also speak to a financial adviser who specialises in retirement planning.—

Conclusion

The UK State Pension is a valuable financial safety net, but it’s important to understand how it works. By checking your pension age, reviewing your forecast, and filling in any gaps in your NI record, you can secure a better income for retirement.

Additionally, exploring other benefits such as housing support, heating bill assistance, or free bus travel can make life after retirement more comfortable.

The earlier you plan, the more confident and secure you will feel about your financial future.

FAQs

Q1. What is the current State-Pension age in the UK?

The State Pension age depends on your date of birth, but for most people it is between 66 and 68. You can check your exact age online

Q2. How much is the full State-Pension in 2025?

The full new State Pension is around £221.20 per week (figures can change yearly). The exact amount depends on your National Insurance contributions.

Q3. Can I increase my State Pension?

Yes, you can increase your pension by delaying your claim or by making voluntary NI contributions to cover gaps in your record.

Q4. Can I claim my pension if I live abroad?

Yes, you can claim your State Pension if you move abroad, although the amount and increases may vary depending on where you live.

Q5. What extra benefits can pensioners claim?

Pensioners may be eligible for Pension Credit, housing support, heating bill help, disability benefits, and free bus passes.