Roblox Stock:

Shares of popular online gaming and immersive experience platform Roblox Corporation (NYSE: RBLX) rose sharply in pre-market trading on Friday following a significant upgrade by analysts. Wolfe Research, a respected equity research firm, changed its recommendation from Hold to Buy and raised its price target to $150.

This is a great opportunity for investors. This bullish trend has caught the attention of investors, especially when the analyst highlighted strong growth factors such as regional pricing, advertising, and new gaming categories.

Why Wolfe Research Upgraded Roblox Stock

The analyst noted that Roblox’s revenue model is expanding beyond its core business. Two specific areas are expected to play an increasingly important role in growth:

1. Regional Pricing – By tailoring prices for different regions, Roblox can make its platform more accessible to a wider global audience. Wolfe estimates this initiative alone could contribute an additional $318 million in bookings by 2026.

2. Advertising – While still in early stages, the integration of ads into the Roblox ecosystem is expected to generate about $300 million in gross revenue, boosting overall profitability.

With these adjustments, Wolfe Research lifted its 2026 bookings forecast by 7% and EBITDA forecast by 13%, putting their projections well ahead of Wall Street consensus.

Platform Flywheel Effect

Roblox isn’t just benefitting from pricing changes and advertising. The firm pointed out the “platform flywheel” effect, where improvements in one area fuel further growth in others. Key drivers include:

Improved search and discovery tools making it easier for users to find games.

Faster content creation powered by generative AI tools.

Pricing optimisations to capture more revenue across markets.

Early-stage ad revenue creating fresh monetisation opportunities.

All of these factors contribute to a virtuous cycle where user engagement drives revenue, and revenue reinvestment drives even better user experiences.

Topics

The Long-Term Vision

Roblox has ambitious goals for the years ahead. The company currently has around 112 million daily active users (DAUs), but it has set its sights on reaching 1 billion DAUs over the long term. Achieving this would make Roblox one of the largest entertainment ecosystems globally, rivalling social media giants.

Artificial intelligence is expected to play a central role in this expansion, enabling quicker game development, smarter recommendations, and personalised user experiences.

Risks Investors Should Note

Despite the optimism, Wolfe Research acknowledged that Roblox faces a few challenges:

Stock-based compensation remains high, which can dilute shareholder value.

Safety and moderation issues are an ongoing concern, especially with a large under-18 audience.

Regulatory scrutiny in different regions could also create headwinds.

However, the firm stressed that these risks have not historically derailed Roblox’s long-term fundamentals.

Valuation Outlook

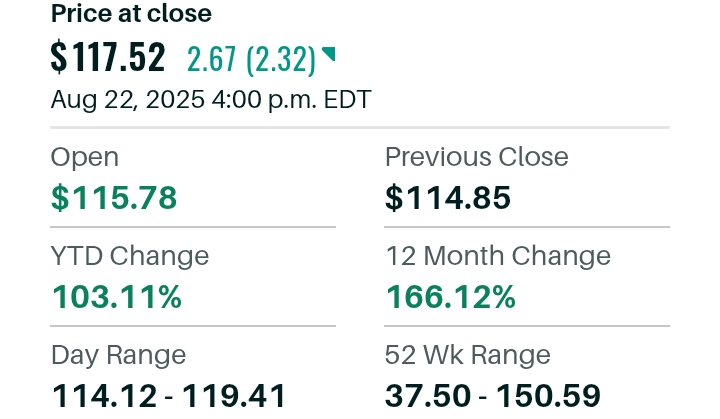

At around 36 times projected 2026 EBITDA, Roblox is trading below many high-growth peers.

For investors looking for exposure to the gaming and digital experience sector, the Wolfe Research note suggests Roblox could be undervalued relative to its growth potential.

Bottom Line

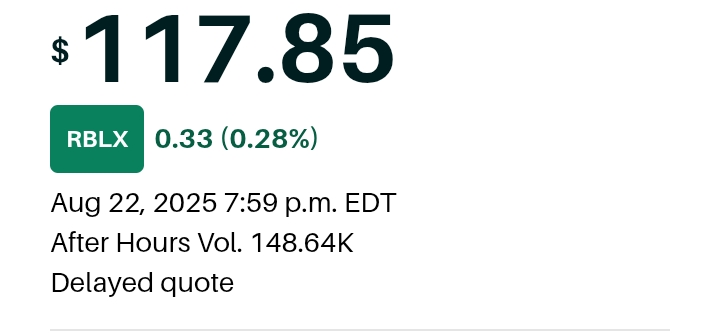

The upgrade from Wolfe Research has injected fresh optimism into Roblox stock, with analysts now seeing meaningful upside to $150 per share.

With new revenue streams from advertising and regional pricing, combined with AI-driven innovation, Roblox is positioning itself as a long-term winner in the global gaming and immersive experience market.

For UK investors keeping an eye on US tech stocks, this could be one to watch closely as the company continues to expand its influence far beyond traditional gaming.

Read more: RBS Life Insurance Review 2025 – Policy Options & Benefits

❓ FAQs on Roblox Stock Upgrade

Q1. Why did Roblox stock rise recently?

Roblox shares gained after Wolfe Research upgraded the stock from Hold to Buy and set a $150 price target, citing new revenue streams like advertising and regional pricing

Q2. What does the $150 price target mean for investors?

The $150 target suggests analysts believe Roblox could climb significantly from current levels, backed by higher bookings and EBITDA forecasts into 2026.

Q3. How is Roblox planning to increase revenue?

Roblox aims to expand revenue through regional pricing (making games affordable in different markets) and by integrating advertising directly into the platform.

Q4. What risks should investors keep in mind?

Key risks include stock-based compensation (which can dilute shareholder value), safety concerns due to a young user base, and regulatory challenges in different regions.

Q5. Is Roblox a good investment for UK investors?

While analyst upgrades are a positive signal, UK investors should consider exchange rate impacts and volatility in US tech stocks before investing. It’s worth adding to a watchlist but requires careful risk assessment.