Finding a Halal mortgage in the UK can be challenging, especially if you want a Sharia-compliant option that avoids interest (riba). In this guide, you’ll learn everything about Islamic mortgages in the UK, how they work, the best providers, and how to apply in 2025.

What is a Halal Mortgage

A Halal Mortgages is a home financing option designed according to Islamic Sharia law, which prohibits paying or receiving interest (riba). Instead of charging interest, the bank and the customer enter into a profit-sharing or rent-based agreement.

Key Features:

No interest Charges (riba-free)

Based on Ijara (lease) or Musharakah (partnership) model

Approved by Islamic scholars

Unlike conventional mortgages, where you borrow money and pay interest, Halal mortgages use alternative structures to keep the process Sharia-compliant

Topics

Why Choose a Halal-Mortgage in the UK

There are Several reasons why Muslims in the UK and ethical finance seekers prefer Halal mortgages:

✔ Sharia compliance – avoids interest completely

✔ Ethical finance model based on fairness

✔ Available from UK banks regulated by the Financial Conduct Authority (FCA)

This makes them ideal for home buyers who want to follow Islamic principles.

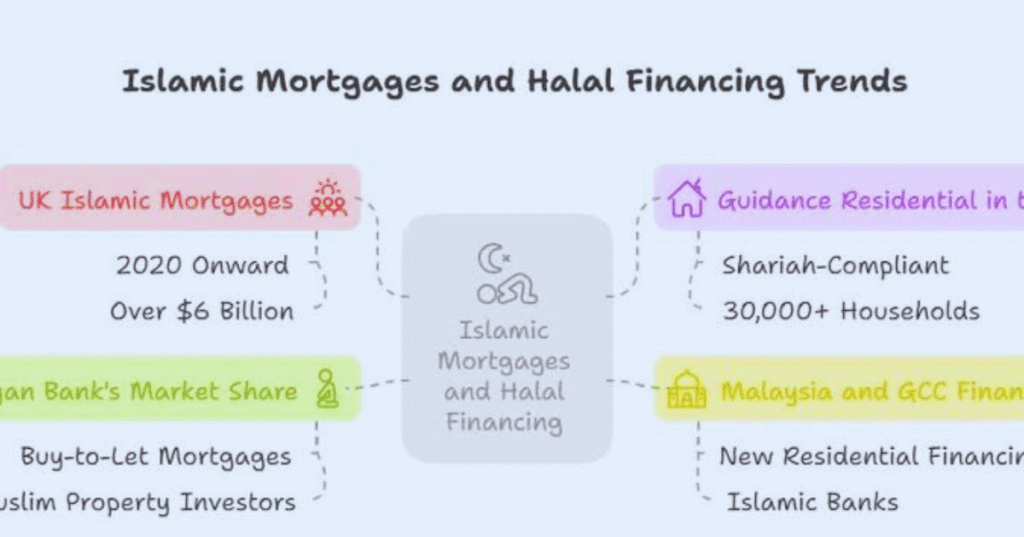

Best Halal Mortgage Providers in the UK (2025)

Hare are Some of the top UK bank offering Halal Mortgage

| Provider | Product Type | Minimum Deposit | Key Feature |

| Gate house Bak | Home Purchase plan | 20% | profit-Sharing Model |

| A1 Rayan Bank | Home Purchase plan | 25% | Sharia Board-approved |

| HSBC Amanah | IJara & Diminishing Musharakah | 20% | Global Islamic finance Brand |

Halal-Mortgage Calculator

Want to know your monthly payment? Use a Halal Mortgage Calculator to estimate your Costs.

Unlike a Standard Mortgages Calculator this tool considers Profit rates instead of interest rates.

How to Apply for a Halal-Mortgages in the UK?

Follow these Steps to Apply for a Halal Mortgage:

1. Choose the right Provider- Gatehouse Bank, A1 Rayan, HSBC, etc

2. Check eligibility- income proof, UK residancy, minimum deposit.

3. Submit Documents: salary slip, I’d proof, bank statements

4. get approval & sign Agreement- based on Sharia compliant Structure.

FAQs on Halal-Mortgage UK

Q1. Is a Mortgage halal in Islam?

A Conventional Mortgage

is not halal because it involves interest. However, Sharia-compliant mortgages avoid interest and follow Islamic principles.

Q2. Are halal-Mortgages in interest-free?

yes they are Interest-free Instead of interest, banks charge profit based on agreements like Musharakah or Ijara.

Q3. Which UK Banks offer halal-Mortgage?

Gatehouse Bank, Al Rayan Bank, and HSBC Amanah are the leading providers.

Q4. Do halal-Mortgage cost more?

They can sometimes be slightly more expensive than conventional mortgages due to the profit-sharing model, but they are Sharia-compliant.