What is PCP Car Finance: PCP, or Personal Contract Purchase, is one of the most popular ways to buy a car in the UK. It offers low monthly payments and flexibility at the end of the contract, making it attractive for many drivers — especially those who like upgrading their car every few years

But how does it work, and is it the right choice for you? Let’s break it down.

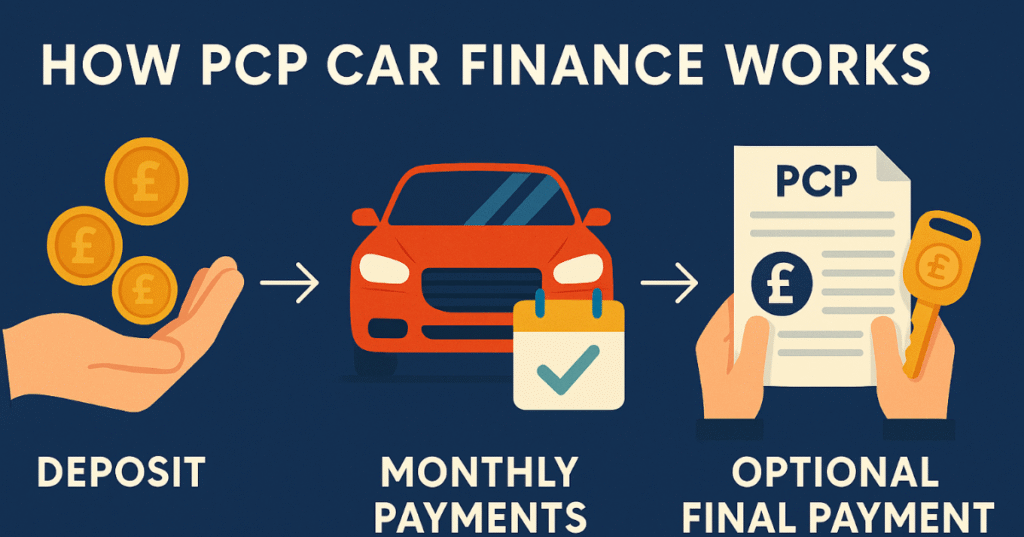

How PCP Car Finance Works

When you take out a PCP deal:

1. Deposit – You usually pay an upfront deposit (often 10% of the car’s value).

2. Monthly Payments – You make fixed monthly payments over an agreed term, usually 2–4 years.

3. Balloon Payment – At the end, you can pay a final “balloon” payment to own the car, return it, or part-exchange for a new one.

The balloon payment is based on the car’s Guaranteed Future Value (GFV), which is estimated at the start of the agreement.

Table of Contents

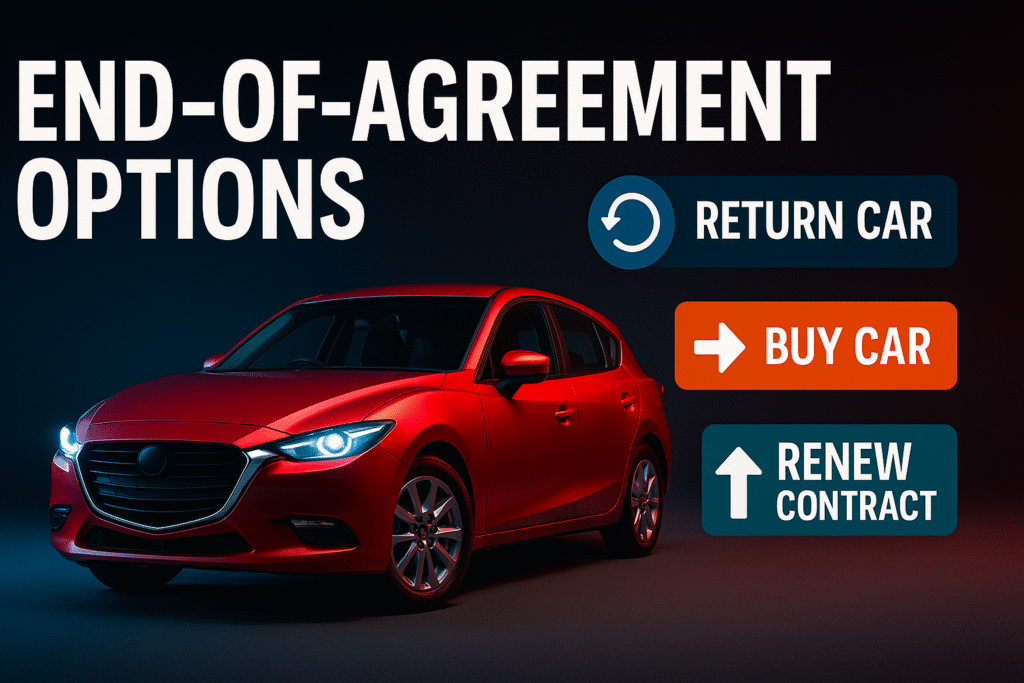

End-of-Agreement Options

- At the end of a PCP contract, you have three main choices:

- Keep the Car – Pay the balloon payment and the car is yours

- Return the Car – Hand the car back with no further payments (subject to mileage and condition checks).

- Upgrade to a New Car – Use any equity as a deposit for another PCP deal.

Pros of PCP Car Finance

- Lower Monthly Payments than Hire Purchase (HP).

- Flexibility at the end of the contract.

- Option to Upgrade cars regularly without large upfront costs.

Cons of PCP Car Finance

- Mileage Limits – Exceeding the agreed mileage leads to charges.

- Condition Charges – Damage beyond fair wear and tear can cost extra.

- No Ownership Until Balloon Payment – You don’t fully own the car unless you pay the final sum.

PCP vs HP (Hire Purchase)

Feature PCP HP

Monthly Payments Lower HigherEnd Ownership Optional (balloon payment) Automatic after term endsMileage Limits Yes No

Who is PCP Best For?

PCP works well for:

Drivers who like changing cars every 2–4 years.

People who want low monthly payments.

Those comfortable with not owning the car immediately.

Costs to Consider

- Deposit – Often 10% of the car price.

- APR (Interest Rate) – Can vary based on credit score.

- Mileage Charges – Typically 5–15p per extra mile.

- Balloon Payment – Can be several thousand pounds.

(FAQs)

1. What does PCP Stand for in Car Finance?

PCP stands for Personal Contract Purchase, a finance option that offers low monthly payments and flexibility at the end of the term.

2. Do I own the car at the end of a PCP?

Only if you pay the final balloon payment; otherwise, you return the car or trade it in.

3. Can I end a PCP early?

Yes, but you may have to pay an early settlement amount, which can be expensive in the first half of the agreement

4. What happens if I exceed the mileage limit?

You’ll be charged a set fee per extra mile, stated in your agreement.

5. Is PCP better than HP?

PCP offers Lower monthly payments and flexibility, while HP gives automatic ownership at the end. The best choice depends on your priorities.

6. Can I get PCP with bad credit?

it’s possible, but interest rates will likely be higher, and you may need a bigger deposit.

-

Lloyds Banking Shake Up: 5% Staff Face Job Axe 2025

Did you know Banking jobs in the UK have always been considered safe, but now this status is being questioned. Lloyds Banking Group, one of the country’s most prestigious high street lenders, has announced a new performance management policy that could put thousands of jobs at risk.The change comes at a time when traditional banks…

-

Sydney Sweeney Ad Sends American Eagle Shares Soaring 2025

American Eagle Outfitters (AEO) is suddenly in the spotlight after a massive surge in its stock price. The U.S.-based fashion retailer saw its shares rise more than 25% in after-hours trading, attracting the attention of both Wall Street and retail investors. Much of the buzz is coming from the brand’s high-profile celebrity campaigns, particularly those…

-

Royal Mail Tracking Down: Users Hit by Major Error! 2025

On September 2, thousands of Royal Mail Tracking customers were left frustrated when the company’s online tracking system crashed. Instead of receiving parcel updates, users received an “internal server error” message, leaving many unable to check the status of important deliveries.DownDetector received more than 500 complaints in a short time, with around 81% of these…